42% of Consumers Prefer Digital Wallets for Cross-Border Payments

Consumers are turning to digital wallets as their preferred method for sending and receiving money across borders, signaling a shift in global money movement.

This trend, highlighted in the January 2025 report, “Global Money Movement: How Digital Wallets Are Transforming Cross-Border Payments,” a collaboration between PYMNTS Intelligence and TerraPay, underscores a growing demand for speed, convenience, and reliability in international financial transactions.

The research, based on surveys of over 2,600 consumers and nearly 400 small businesses across Saudi Arabia, Singapore, the United Kingdom and the United States, reveals a clear preference for digital wallets over traditional methods like bank transfers and money transfer services when it comes to cross-border payments. This preference is driven by perceived benefits such as faster payment speeds and a growing sense of trust in these digital platforms.

The report’s findings indicate that digital wallets are not just a niche solution but are becoming the mainstream choice for a substantial portion of consumers engaged in cross-border financial activities.

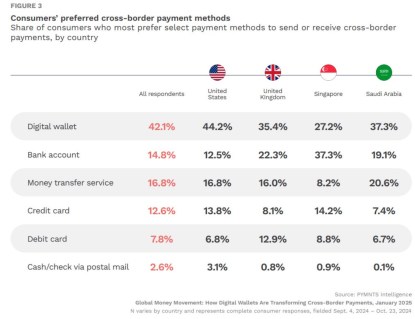

Notably, 42% of consumers surveyed already prefer to send and receive cross-border payments using digital wallets, surpassing any other single payment method. Moreover, nearly half of the consumers who are not using digital wallets for international transactions anticipate adopting them for peer-to-peer (P2P) payments in the near future, pointing towards further expansion of digital wallet usage in this domain.

This burgeoning adoption is particularly evident in the United States, where 44% of consumers cite digital wallets as their most preferred method for cross-border payments. The report also sheds light on the coordination between senders and receivers, with 64% of digital wallet cross-border payers coordinating to use the same wallet as the recipient, highlighting the network effects driving adoption.

Wallet Use on the Upswing

Key data points from the report underscore the importance of digital wallets for consumers in cross-border payments.

Digital wallets are the most popular method for cross-border payments among consumers when available, with 42% citing them as their top choice. This preference outweighs traditional bank account transfers (14.8%) and money transfer services (16.8%).

U.S. consumers sending cross-border payments are 92% more likely to cite speed as a reason for using digital wallets compared to bank accounts, emphasizing the value placed on swift transactions.

Furthermore, trust also emerges as a key factor when consumers choose their preferred digital wallet. A majority (64%) of consumers who use digital wallets for cross-border payments coordinate with the receiver to use the same digital wallet, demonstrating the importance of interoperability within wallet systems.

Beyond these core findings, the report reveals that consumers primarily use cross-border payments for remittances to family and friends, with nearly three-quarters of U.S. consumers making such payments. This focus on P2P transfers explains why digital wallet adoption is highest in this area, with 38% of consumers preferring digital wallets for sending remittances.

Interestingly, consumers tend to use digital wallets for smaller-value remittance payments compared to other methods, suggesting they are becoming the go-to for routine, lower-stakes international transfers.

Moreover, consumers who are more familiar with digital wallets overall are more likely to use them for cross-border transactions, indicating that increased digital literacy will further fuel adoption.

Perhaps most compellingly, 39% of U.S. consumers using digital wallets for cross-border payments report no disadvantages to this method, a higher satisfaction rate than with any other payment option. This positive perception, coupled with expectations of increased frequency and value of cross-border payments in the coming year, positions digital wallets as a force shaping the future of international consumer finance.