Merchants Make the Sale When Consumers See Preferred Payment Options

Consumers are less confident about economics — on a macro and a personal level — than they have been for quite a while.

They’re mulling where they can throttle back spending, and in other cases they may be shifting how they want to pay, using credit, or buy now, pay later (BNPL) options to stretch payments out over time.

For merchants, it’s more critical than ever to make sure that they are offering end users the payment methods they want to use, when they want to use them.

Friction at the Point of Sale

In the PYMNTS Intelligence report “What Consumers Do When Their Go-To Credit Choice Is Unavailable,” we found that there are a number of scenarios in which a retail payment hits a speed bump. A consumer may be nearing their credit limit or may find that they want to use a card that has rewards tied to the purchase. When the friction is in the mix, consumers may be tempted to switch to another payment option, which takes time, or they might opt to walk away from the purchase altogether — which has a dual, negative effect. The customer does not get what they wanted, and the merchant, of course, loses out on incremental revenue.

Of the 2,342 consumers we surveyed, among consumers who recently made an essential purchase using credit, 76% used credit cards, 6.1% used BNPL or other installment plans, and 18% used some other form of credit. The preferences for certain payment vehicles remained relatively consistent for nonessential purchases, where 73% used credit cards, 10% used BNPL or installment plans and 18% opted for another type of credit.

As for the impact of not having the credit option immediately on offer that they’d wanted, the interruption of commerce proves significant: For essential expenses, shoppers most frequently said they would likely use a different credit product, at 37%. And 1 in 3 said they would skip the purchase. Again, the percentages are similar for the nonessential expenses, as more than a third of shoppers most often say they would likely skip or delay the purchase. Using another credit product follows closely, at 32%. It should be noted here that the nonessential purchases might include anything from candy to clothes, and impulse buying may be the most immediate casualty of the current macro environment.

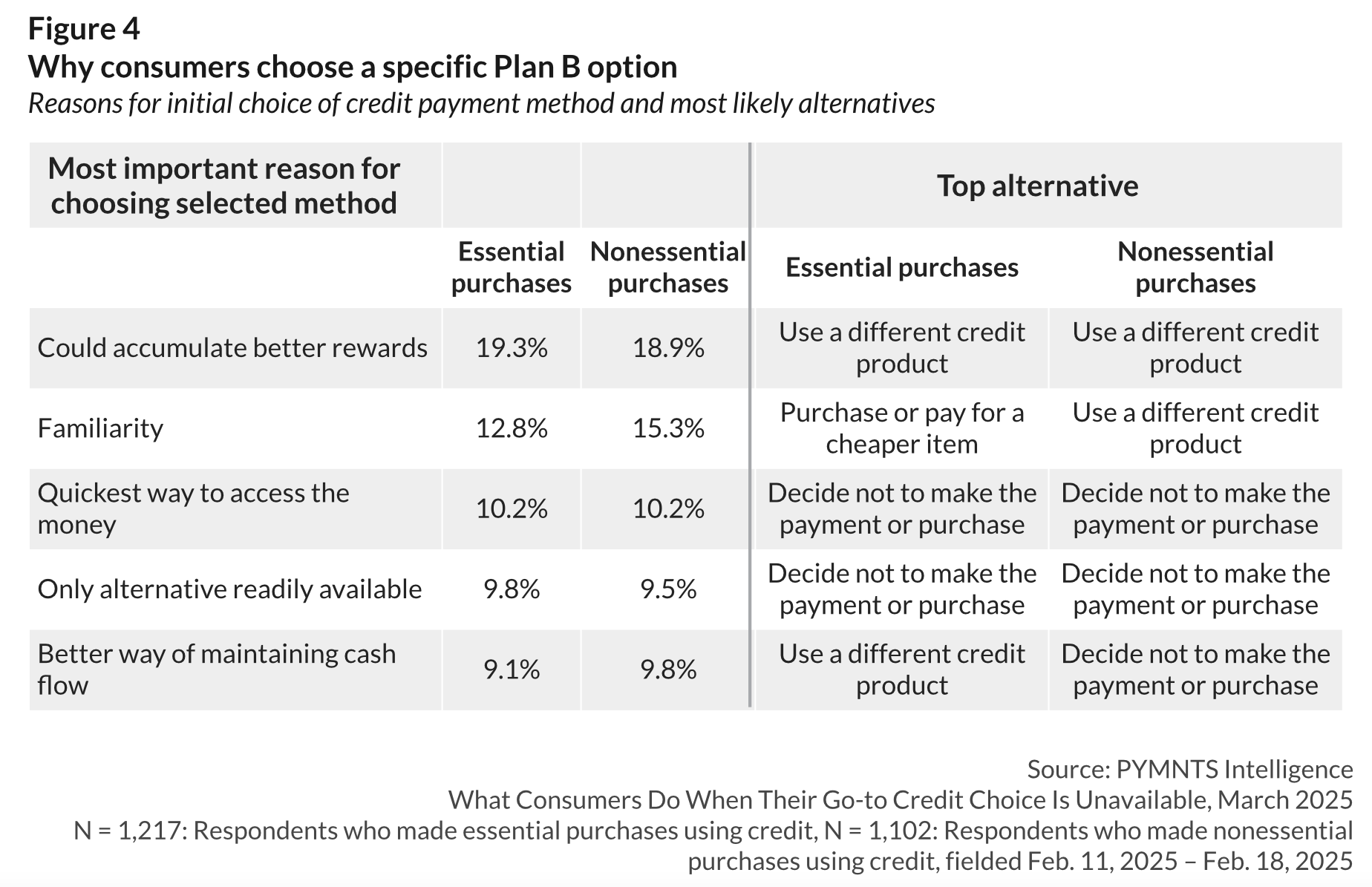

“When shoppers cannot use their selected credit product, their backup plan depends on what they value most in their initial payment method choice,” the report found. There’s at least some stickiness when it comes to using credit for the cash back and other rewards. PYMNTS Intelligence found that among the consumers who name better rewards as the top factor behind their original choice would most likely use another credit option. Meanwhile, respondents who initially selected the quickest or only way to access money would mostly skip the purchase. This implies merchants that also tie their interactions with customers into a promotional or other type of offer may be able to get consumers to move to clicking the buy button.

Consumers who say familiarity drove their initial credit payment preference show the most dynamic behavior between essential and nonessential purchases, our data showed, which means that using credit is top of mind and top of wallet. When the expense is nonessential, they are most likely to use a different credit product, at 27%. This share falls to 20% for essential purchases, behind choosing a cheaper alternative, at 23%.